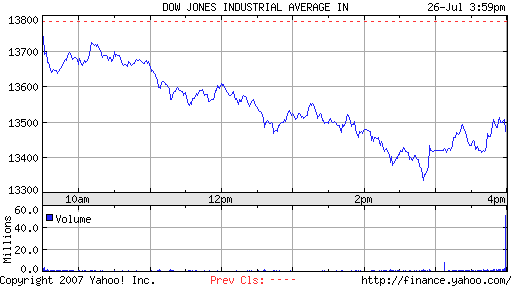

Blowing the dust off this post from earlier this month, could yesterday’s falls in the global markets be the beginning of a bigger movement?

Here’s a wrap-up of yesterday’s / today’s (depending on which side of the international date line you’re on) trading:

Hardest hit was South Korea’s KOSPI index – down over 4%.

All of the European bourses reacted to the Dow’s decline of 2.26% and shed between 2% to 3% of their value — the UK’s FTSE 100, for instance, suffered its biggest one-day fall for five years, wiping all out of 2007’s gains in just a few hours.

Bucking the trend, however, were China’s benchmark Shanghai Composite Index, down a modest 24 points (0.56%) and India’s Karachi SE 100 index, down less than 1%.

Will there be a bounceback? Short-term, for sure, the best time to buy is on bad news like this.

But in a related development worth watching, the VIX index, the benchmark for U.S. stock volatility surged to its highest point in 13 months. More siginficantly still, the VIX has come within 2 points of 50 on only three occasions in the past decade. The first, on Oct. 8, 1998, came as losses mounted from Russia defaulting on its debt. It reached another peak 10 days after the terrorist attacks in September 2001, and again surged in July 2002 as fallout from Enron Corp.’s collapse drove down shares of its main lenders and former rivals.